Choosing Comparable Sales

When choosing comparable sales for an appraisal, often times there is more analysis done than most people realize. The use of distressed properties for an appraisal is sometimes unavoidable, especially if their concentration is more prevalent than non-distressed sales.

Why Distressed Sales May Be Needed

The appraiser should indicate as to why distressed sales were needed within their appraisal report, which is why for every appraisal I estimate the concentration of distressed sales within the subject’s market area.

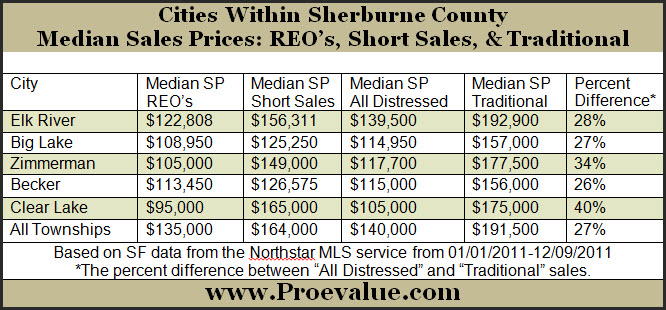

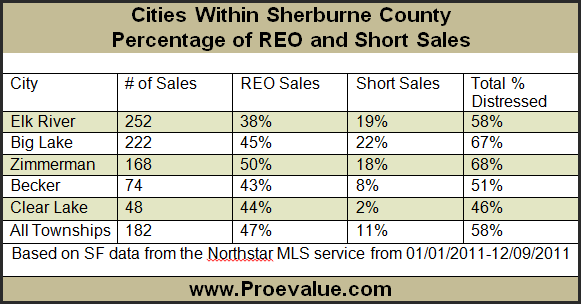

The chart above is for cities within a certain county; however, I use the same process when appraising a property within a certain neighborhood and/or market. This helps to explain to the client as to why they were needed within the appraisal report.

Adjusting for Stigma

If a decision has been made to use a distressed comparable sales for an appraisal, then there is most likely going to be an adjustment for stigma.  As you can see from the chart above, there is definitely a significant difference between the different median selling prices for the different types of properties. I do a similar analysis for the particular type of property being appraised within it’s neighborhood or market area.

As you can see from the chart above, there is definitely a significant difference between the different median selling prices for the different types of properties. I do a similar analysis for the particular type of property being appraised within it’s neighborhood or market area.

Adjusting for Condition

When using distressed sales for an appraisal, besides making an adjustment for stigma, there is most likely going to have to be an adjustment for condition. This is going to be based on some research done by the appraiser. The following is some examples of ways to assess the condition of comparable sales:

- Use interior/exterior photos supplied by the MLS

- The MLS description will often tell if there were major problems

- Check for prior expired and or cancelled MLS listings

- Contact the agents involved in the sale for any major issues

- Get the opinion(s) other Realtors that do a lot of work in the area as to how a particular comparable sale compares to other sales

By juxtaposing two pictures of bank foreclosed properties, you can see that there can be a significant difference between the levels of condition. That’s why it’s important to do some investigating, and try to ascertain the condition of the comparable sales being used within an appraisal report.

Making the Adjustment When Using a Distressed Sale

There is no magic formula for determining how much of an adjustment should be made to comparable sales when using distressed sales (short sales, bank REO’s, divorce properties, estates, or relocation) for an appraisal; however, by doing some analysis of the different median selling prices, and by confirming the condition of the comparable properties, the appraiser will be able to come up with a very defensible adjustment, or why one wasn’t used.

If you have any questions, or MN real estate appraisal needs (divorce, bankruptcy, tax appeal, or estate planning) please contact Michael at 612.599-2581, or use the form on the contact page.

No related posts.

{ 4 comments… read them below or add one }

Excellent details in the post, Michael. I’ve seen so many kitchens as you showed above. They do tend to get stripped – though thankfully not always.

Thanks Ryan! I haven’t had too many like this lately, but they do make our job more interesting. And I thank you for all the inspiration you give us fellow appraisers, you’re leading the way for us to follow, very much appreciated.

Michael,

Great explanation of the process appraisers use. Looks like you have some pretty distressed areas where you live (46-68% of properties distressed). I don’t think I have done an appraisal in the last year where I did not have to use at least one foreclosure. They are just to prevelant.

Hey Tom,

I’m not sure why my original reply didn’t go through, but thanks for the comment. In the city I live in, the distressed sales are 85-90% for many types of homes. That’s level is way to high, although inventory levels have dropped dramatically, which will hopefully help values.

{ 1 trackback }