For every appraisal done on the Fannie Mae Form 1004 appraisers have to figure out what’s happening with current values (the past 12 months) within a given properties neighborhood and/or market area. Short term market trends differ from long term trends, but Fannie Mae tends to be more concerned with what’s been happening within the past 12 months.

Given the current real estate climate, getting this right is more important than ever. If it’s been determined that the values are declining and/or there’s an over-supply of homes, most lenders may require the following:

- At least one to two similar comparable active listings or pending sales that support the appraised value.

- At least two of the comparable sales used within the appraisal must have sold in the past 90 days.

- If there is a high-concentration of distressed sales, then some lenders require that at least one of the comparable sales be a distressed sale used within the appraisal.

I look at three different metrics when estimating as to whether real estate values are increasing, decreasing, or are considered to be stable.

MLS Market Statistics

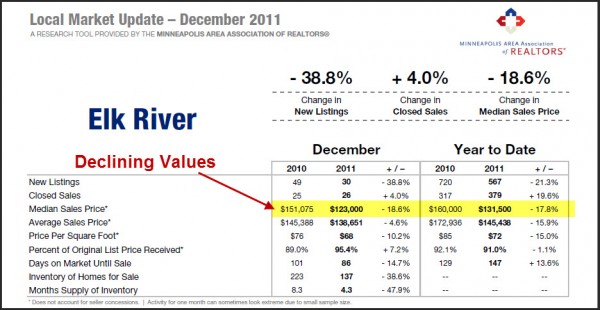

Most real estate professionals have access to some type of multiple listing service, which usually has statistics for a given city or county. (The multiple listing service that I subscribe to has public access to this information.) The challenge with relying on this data is that it tends to be too broad; however, it does give a general idea as to what’s happening. For example the analysis below is for the City of Elk River, MN, which the MLS indicates that overall prices are declining.

The 1004MC Report

To help appraiser’s (more like force them) figure out what’s happening with values within a particular neighborhood (marketplace) Fannie Mae in 2009 introduced the 1004MC report. The most important aspect of this report is the data that is inputted; garbage-in equals garbage-out. The data for this report should contain “only” similar competing properties within the identified neighborhood and/or market area. This is different from the MLS statistics, which are the aggregate prices for an entire city or county. Some MLS systems have this reporting feature available. If your MLS system doesn’t offer this type of report, there are some Excel programs floating around on the internet.

12 Month Trend Analysis

I take the information that I’ve gathered for the 1004MC report and go a couple of steps further. I break down the data into both distressed and non-distressed to see if there has been a bifurcation of the market. This I feel is crucial, because if there is a high concentration of distressed properties you need to know the amount of stigma that can be associated with distressed properties. As you can see by the graph to the right, over the past 12 months prices have been increasing. (Click here for article on how appraiser’s adjust for stigma.)

Final Analysis

Instead of just relying on the MLS statistics, and by taking a few extra steps, you get a much different picture as to what’s really happening within a properties neighborhood and/or market area. For this particular example, at the very least I would consider prices to be stable or even slightly increasing. By putting this data within an appraisal report, or even a CMA, you’re creating a report that truly represents what’s happening, and you’re not misleading the reader.

A Final Note to the Real Estate Industry

Does this take more time, absolutely! Do most appraisers do this level of analysis-I would hope so, but probably not. Should the pay be commensurate to the level of work involved-you bet. This is why I refuse to do work for appraisal management companies (AMC’s) that want to take 40-50% of the appraisal fee. They want a sit down dinner at fast food prices, and I’m worth more than that. There are some AMC’s that understand this, and pay fees that are more in line with the going rate. It tends to be the big box lenders that have their own AMC’s that want to pay cut rate fees. There’s an old saying, “You get what you pay for,” which is something that should be considered before choosing a lender.

No related posts.