Every appraisal for a purchase that is done on the Fannie Mae 1004 form, the appraiser is required to analyze the purchase agreement. Some say that the only thing that appraiser’s look for is the sales price so they know what number to hit (or some would say what number not to hit). While it is true that the sale price is probably one the main aspects considered when analyzing a purchase agreement, however, there are five other things that I look at, which obviously can vary from one appraiser to another.

Seller Concessions

This tends to be the one thing that most lenders are concerned with, and sometimes it can take some real detective work to figure out. Concessions can come in many forms:

This tends to be the one thing that most lenders are concerned with, and sometimes it can take some real detective work to figure out. Concessions can come in many forms:

- Cash contribution towards the buyers closing costs/pre-paids.

- The inclusion of personal property (certain appliances, lawn mower, snow blower, farm equipment, etc.).

- The finishing off of unfinished areas within the house.

- Builder incentives (upgraded features, loan incentives, appliance packages, finished bonus rooms).

The main objective is to figure out how the final sales price was derived. Seller concessions shouldn’t be adjusted necessarily dollar for dollar within the appraisal, but more on how the market precieves the concession.

Subject To Repairs

Most lenders want houses to be appraised “as is,” meaning their current state of condition. However, there are times when sellers have agreed to complete or fix certain things, which most lenders will want done prior to closing. Then the property will be appraised “subject to” whatever needs to be repaired or completed. Not to get to technical, but this is also known as a “hypothetical” condition.

Disclosure Statements

This is a great place to look to see if there are any major problems with the house, assuming that the seller is being truthful (trust but verify). Some of the most salient things I look for are:

- Age of the roof, have there been any repairs.

- If the property has a private septic system: how old is the system, when was the last time it was pumped, does it meet code.

- Are all of the mechanical’s in working order.

- Are there any encroachments or easements that have been identified.

- If the property has a private well there’s usually some type of map indicating its location, this helps to verify that the well and septic meet the proper distance requirements set by the lender.

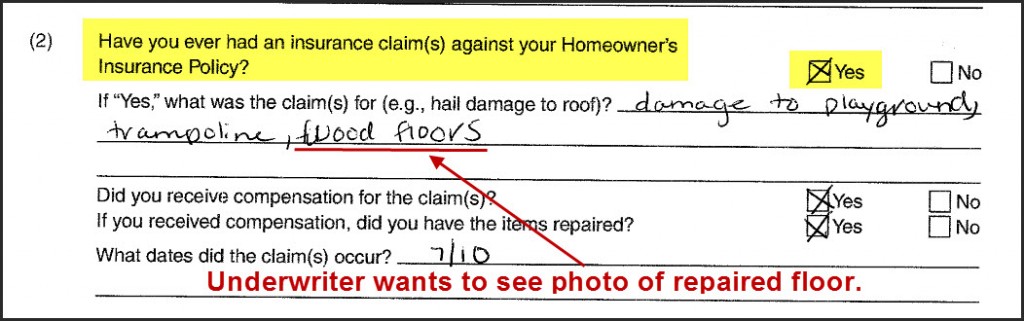

- Has there been any insurance claims against the property, and if so was the money used to fix the damage.

Special Assessments

Most purchase agreements address if there are any pending or levied assessments, which the appraiser may not be aware of due to them not being of public record yet (not recorded on the counties tax website). Many times the title work hasn’t been completed by the time the appraiser has inspected the home, or the homeowners were just notified of pending assessments, thus relying on the information within the purchase agreement can become critical.

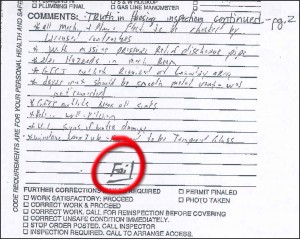

Code Compliance And/Or Home Inspection Reports

I just did an appraisal for a purchase of an REO property, and the last two pages of the purchase agreement the code compliance report had been attached from the city. Both pages indicated that the property FAILED the inspection! This would need to be addressed within the appraisal report.

I just did an appraisal for a purchase of an REO property, and the last two pages of the purchase agreement the code compliance report had been attached from the city. Both pages indicated that the property FAILED the inspection! This would need to be addressed within the appraisal report.

There are also issues within the inspection report that were addressed in the purchase agreement, and thus these would also need to be addressed within the appraisal report. There have been times that the underwriter has asked the appraiser to analyze ALL of the issues within an inspector’s report, not just those within the purchase agreement.

It’s important to remember that the appraiser is the eyes and ears for the lender, they want to know what they’re lending against. Most people don’t realize the level of research and verification of data that goes into an appraisal, and analyzing the purchase agreement/contract is one of those important factors that can’t be overlooked-what’s in the purchase agreement counts regarding the appraisal.

No related posts.

{ 3 comments… read them below or add one }

It makes perfect sense. If I were lending money on a home, I would want to know the risks to the value including any “personal property” that is wrapped into the deal – because we all know, when the default happens – everything is stripped out of these homes! (sometimes even the copper plumbing!)

What I find informative is all the work you have to go through to establish an appraised value. I used to get frustrated at the appraisal fees – not any more!

I haven’t run into a stripped property for some time, that was until a couple of weeks ago. Yes, it’s very rare that anything of value is left behind.

When I was a selling real estate I would think the same thing about appraisal fees, obviously not any more. Many appraisers are getting out of the business because they don’t feel the appraisal fees are commensurate with the level of work that is involved in today’s market.

…as are Realtors and mortgage bankers.

Wonder what the industry will look like in another few years?