FHA Appraisals and High Voltage Power Lines

Many times there are circumstances that real estate professionals don’t have to deal with on a regular basis, and power lines are one of them. Understanding what to do will keep your sale from being….Zapped!!!

Many times there are circumstances that real estate professionals don’t have to deal with on a regular basis, and power lines are one of them. Understanding what to do will keep your sale from being….Zapped!!!

I recently had a Realtor friend call me in a panic; a house he had just sold (a short sale he had been working on for months) was located near High Voltage (HV) power lines, and the underwriter didn’t want to approve the loan due to the property being located near the HV power lines. This was for a FHA loan, and there was some confusion as to the interpretation of the FHA guidelines.

What does FHA have to say:

The guidelines for this are pretty straightforward; however, the challenge is proving the property is located outside the easement.

The guidelines for this are pretty straightforward; however, the challenge is proving the property is located outside the easement.

The guideline from the HOC Reference Guide (Hazards and nuisances 1-18) states (this is also reaffirmed in HUD’s FAQ’s): “If the dwelling and related property improvements are located outside the easement, the property is considered eligible and no further action is necessary.”

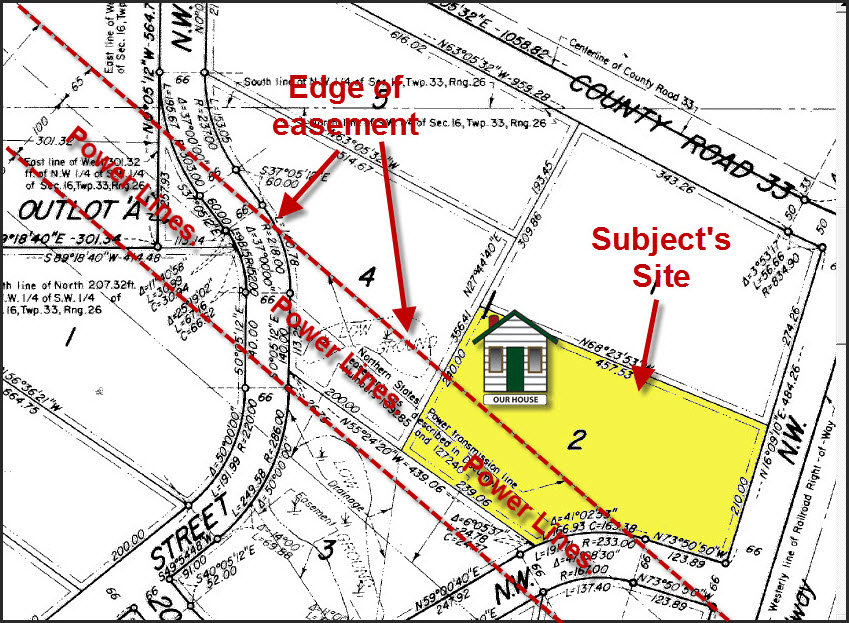

To help my friend satisfy the underwriter (this wasn’t my appraisal) I put together a plat with the power line and easements, and the estimated location of the subject property. A better solution would have been to obtain a copy of the actual survey with the house and power company’s easements located on it, however, this is all I had access to (see photo below).

Below is an example of what to show the underwriter:

With this picture the Realtor was able to show the underwriter that the property met HUD (FHA) guidelines of being located outside of the easement for the power line. The actual location of the house could be verified with the plat from the title company, or one could be obtained from other sources. The main point is to show that the house is outside the easement.

With this picture the Realtor was able to show the underwriter that the property met HUD (FHA) guidelines of being located outside of the easement for the power line. The actual location of the house could be verified with the plat from the title company, or one could be obtained from other sources. The main point is to show that the house is outside the easement.

What to do if built within the easement:

The real challenge comes when you’ve had someone who built a portion of their home, or added other improvements (fence, pool, garage, shed, etc.) located within the easement. HUD’s guideline for this is the following: “If the dwelling or related property improvement is located within such an easement, the DE Underwriter must obtain a letter from the owner or operator of the tower indicating that the dwelling and its related property improvements are not located within the tower’s (engineered) fall distance in order to waive this requirement.”

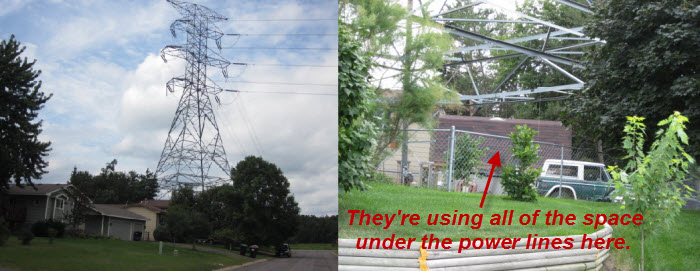

Below are two examples of where you might have a hard time proving that the improvements are not under the HV lines. Both pictures clearly show that the owners have built improvements under the HV lines, although the actual house wasn’t under the HV lines.

With improvements located under the HV power lines I would get the letter from the owner of the power lines indicating that the actual house isn’t under them. I would then seek a waiver from HUD (HOC). This is something that the lender has to do. But knowing what can and can’t be done can make all of the difference.

Similar comparable sales are needed:

The appraiser still has to address the effect on the marketability due to the property being located near a hazard or nuisance (external obsolescence), in this case the power line. The best way to do this is to have at least one or two comparable sales that similar exposure to the same type of hazard or nuisance.

If you are unable to find any similar sales that have sold near a HV line, then try to find similar sales near one of the following: a major freeway or busy road, radio or transmission tower, heavily used commercial property. Your goal is to find a similar sale that suffers from similar external obsolescence; in layman’s terms, something that buyers are going to have similar objections too and that can’t be corrected.

How to keep your sale from being electrocuted:

In summary if you’re getting ready to list or sell a property that is located near high voltage transmission lines, I would do the following:

- Get a plat of the property that shows the location of all of the improvements, as well as the easements.

- Locate all improvement on the plat, measure the actual distance from the lot lines if necessary.

- If there are no encroachments to the easement, then the property would qualify for FHA financing.

- However, if there are encroachments the lender will most likely require a letter from the owner of the tower stating the designed fall distance of the lines (get the letter).

- Have some similar comparable sales that sold near the same power line or something similar, even if they’re older sales (12-18 months).

With some proper pre-sale legwork you’ll be able to have a smooth transaction from start to finish, and no last minute shocking surprises.

*Photo used courtesy of the American Museum of Science and Energy.

Related posts:

{ 10 comments… read them below or add one }

Great post, Michael. I first saw this on ActiveRain and agents are loving you for this one. Very helpful.

Ryan, As I mentioned in the post trying to help out a Realtor friend is what made me dig into this, regarding the concerns with FHA. I’m hoping that this will help someone else not have to do as much digging as I had to.

We have a current situation in which the appraiser for our FHA loan is saying the driveway is a related property improvement. Since part of the driveway is in the electrical easement, the appraiser is saying we need the letter from the electric company designating the tower’s fall distance. What is your experience regarding driveways being regarded as improvement by the FHA? Thanks!

Roger Schmidt

Roger Schmidt Realty

3543 Hidden Cove Circle

Lewis Center, Ohio 43035 614-578-7418

Technically the appraiser is correct, it’s an improvement. I’ve never had this particular situation arise before, but I sure would ask HUD for a waiver, being if the actual house isn’t within the easement. This is something that the underwriter can most likely override also. Hope this helps.

Thank you very much, Michael!

Roger

Very good article with fantastic FHA information. Thank you. The only thing I’m flinching at is your bias that this surely is an adverse situation to live near a high line. Studies on this have not been so conclusive. I suggest that you read this study and test YOUR market and verify if indeed there is any external obsolescence. http://www.real-analytics.com/TAJFall07p.323-325.pdf

Thanks

Hi Mark,

Thanks for the comment and the link to the article.

How do you find out on the BLC if a listing has a power line anywhere near the home? Is there a way to look on a certain mapping function? I tried looking at aerial maps but could not really distinguish anything.

Hi Kathy,

I’m not sure what “BLC” is, but it can be tough sometimes trying to figure out if a property abuts a power line without actually viewing the property. Many times if it’s a HV power line you can see where all of the tress have been removed from an aerial photo, and can see the path of the power line.

Thanks for stopping by, hope that helps.

Michael, thank you for going into such detail on this issue. I landed here because our entire community is concerned about some planned upgrades to the transmission lines in the neighborhood.

It has been 30 years since they put in the 35′ wooden poles that the high voltage lines are on now, and they want to double the circuit and increase pole height in some cases to over 100′.

In your opinion, would the electric company need to be the one jumping through hoops if their new fall distance or easement affects existing homes or improvements? For instance, taking a home/improvement that was outside of the 35′ poles easement and now putting it in jeopardy beneath a new 100′ poles easement?

{ 1 trackback }