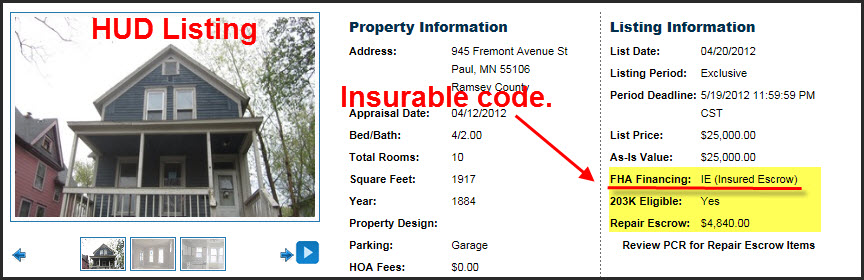

There always seems to be some confusion when it comes to appraisals and HUD homes regarding the insurable code that was assigned to it. For every HUD home listing, the appraiser that did the appraisal determined what it’s going to take for the property to meet HUD’s minimum property standards (MPS). The home has also had an inspection preformed by a third party to help to determine the property’s condition, with the results put in what is called the PCR (property conditions report). If a potential buyer wants to purchase a HUD home using FHA financing then understanding these codes will help to determine if the home can qualify, and if so under what conditions.

As you can see from the picture above that this property will qualify for FHA financing, however, there are is work that needs to be done, which is why there’s an escrow for funds until the work has been completed. It’s highly recommended that if you’re interested in purchasing a HUD home that you find a mortgage officer that has experience in dealing with this type of lending.

Glossary for HUD Insurable Terms

Here’s a link to the HUD Home Store if you’re interested in seeing what homes are currently for sale. Below is a glossary for the insurable terms used in HUD’s listings.

- IE = Insurable. with repair escrow. This property requires repairs estimated to cost no more than $5,00o; it is eligible for an FHA-insured loan provided the purchaser’s lender sets up a repair escrow at closing.

- IN = Insurable. This property is eligible for an FHA-insured loan in its current condition.

- UI = Uninsured. This property requires repairs estimated to cost more that $5,000; it is not eligible for an FHA-insured loan, unless a 203K loan can be arranged. Follow this link for more information on HUD’s 203K programs.

Things To Consider When Buying a HUD Home Regarding Condition

There are two things that I would highly recommend when purchasing a HUD home. First, try and get a copy of the appraisal that was completed for HUD. Many times there are deferred maintenance issues that have been listed in the appraisal, and the cost cure them. Deferred maintenance items aren’t required to be repaired to meet FHA minimum property standards, however, they can have an effect on value.

Second, get a copy of the PCR that was done for HUD. This is a very succinct inspection report, but it does cover the main issues that are required to meet FHA’s minimum property standards.

Should You Still Have a Home Inspection

I’ve heard from real estate agents that buyers seem to want to forgo the expense of having a home inspection done when buying a HUD home, being that there has already been two inspections completed; both by the appraiser and the company that did the PCR inspection for HUD.

I’m of the opinion that neither were intended to replace an inspection by a professional home inspector. I would highly recommend getting a home inspection; HUD homes have sometimes been sitting vacant for many months, and should be thoroughly inspected prior to purchasing.

Related posts:

{ 2 comments… read them below or add one }